This type of liquidity is essential for giant institutional buyers, such as hedge funds and funding banks, who have to buy/sell massive quantities of contracts with out significantly affecting the price. Buyside/Sellside Liquidity is an indicator that identifies buy-side and sell-side liquidity in real-time. Buy-side liquidity represents a stage on the chart where brief sellers will have their stops positioned. Sell-side liquidity represents a degree on the chart the place long-buyers will place their stops.

The investment banks are very energetic, each buying and selling and taking positions within the bond market. Equity, Futures, Crypto and foreign forex trading accommodates substantial threat and isn’t for each investor. An investor may doubtlessly lose all or more than the initial funding. Risk capital is money that might be lost without jeopardizing ones’ monetary security or life style. Only threat capital ought to be used for trading and solely those with sufficient risk capital ought to think about buying and selling.

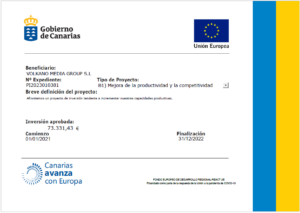

Ict Hrlr & Lrlr – Excessive & Low Resistance Liquidity Run

Hypothetical efficiency results have many inherent limitations, a few of that are described below. One of the restrictions of hypothetical efficiency results is that they’re usually prepared with the good factor about hindsight. In addition, hypothetical buying and selling doesn’t contain financial threat, and no hypothetical trading report can fully account for the influence https://www.xcritical.com/ of economic threat of precise trading. For example, the ability to resist losses or to stick to a selected buying and selling program in spite of trading losses are material factors which can also adversely have an result on actual trading results.

Some traders can also apply these methods to different investment instruments, similar to equities and commodities. Retail traders use ICT to search for imbalances out there, examine sensible money’s buying and selling behaviour patterns and profit from large value swings. A sharp increase in quantity round key ranges can indicate a potential breakout, which can result in the price transferring further into the liquidity zone. It enables them to identify key market levels and deploy capital effectively, contributing to raised total financial efficiency. When central banks reduce liquidity during financial restoration, these bubbles burst, causing market fluctuation and vital investment losses, sustaining doubt.

In the financial realm, market liquidity operates similarly—too a lot or too little can pose points. Market liquidity refers to the ability of a market to successfully deal with giant buy and promote orders. It measures the extent to which the actual trade worth aligns with the anticipated worth, despite the dimensions of the order. So market after searching liquidity of one side moves to hunt the liquidity of different aspect as you presumably can see in the image under.

Related Indicators

These levels are deemed to contain promote facet liquidity as a end result of concentration of pending sell orders. Determining where and how to attract a Fibonacci sequence could be difficult, which is why some of the well-liked ‘Auto-analysis’ instruments on the TrendSpider platform is the Auto-Fib drawing tool. To make the most of this tool, merely click on the ‘Auto Fib’ button in your top toolbar and a Fibonacci sequence will be drawn on the most lately completed move per the time frame selected. After the value reaches a liquidity level after which reverses, what’s going to often come next is Displacement.

The integration and application of ICT trading concepts can deliver a considerable enhance to a trader’s performance. When prices attain these buy side and promote side liquidity levels, a large quantity of orders are executed, leading to an imbalance within the market’s provide and demand. This ends in a sudden surge or decline in price, relying on the direction of the breakout. Investment banks dominate the sell-side, with the most important being Goldman Sachs and Morgan Stanley. JP Morgan Chase and Bank of America, which mix industrial and funding banks beneath a single holding company, underwrite and handle bond points.

These embrace stop losses, retail buyers, price modifications, and the principle roles of consumers and sellers out there. Traders can search for setups supporting the continuing development when the value exceeds important liquidity levels. It’s crucial to note that buy-side liquidity refers to a sure degree on the chart. And the market makers mostly try to hunt the liquidity of retail traders.

Risk Disclosure

It gives flexibility for setting particular selling costs or promoting at the current market worth. The indicator will provide you with two hidden plots to mark the next Buyside or Sellside liquidity levels to make use of in your automated buying and selling strategy. Unveil the untapped potential of your trading technique with the Buyside & Sellside Liquidity Indicator. A beacon of perception on the earth of ICT Trading methodology, this indicator empowers you with a deep understanding of liquidity dynamics. In essence, the concept of sell aspect liquidity underscores the strategic interplay between merchants and market makers, with sell cease orders serving as pivotal devices on this dynamic course of. These counter-trend moves are the outcomes of lower timeframe liquidity looking.

After learning this article and working towards within the markets, you might be able to spot resting liquidity in the market like a professional. In order to get essentially the most up-to-date measurement, do be sure to click on the refresh button in the prime left nook of your chart view. By clicking refresh, all auto-analysis tools shall be up to date to incorporate essentially the most current candle. TrendSpider offers auto-discovery of Fair Value Gaps for all of its customers via the ‘Fair Value Gap’ indicator. In order to entry it, click on the three dots next to the ‘Indicators’ button in the high toolbar.

While novices can undertake ICT strategies, it is strongly recommended that they have a solid grasp of basic ideas. Beginners may discover it beneficial to begin with less complicated trading methods and gradually work their method as much as extra advanced ways. Unlike different buying and selling techniques or software program, ICT isn’t a one-size-fits-all method. It is a collection of strategies, fashions and ideas that can be applied to different market conditions and buying and selling types.

The sell-side and buy-side of Wall Street are two sides of the identical coin. One depends upon the opposite and couldn’t function without the opposite. The sell-side tries to get the best price potential for every financial instrument while providing insight and analysis on each of those monetary property. It entails the power to rapidly enter or exit a commerce, which impacts worth movement.

Key Ict Ideas

On the sell-side of the equation are the market makers who are the driving force of the financial market. For example, any individual or firm that purchases inventory to sell it later at a profit is from the buy-side. Though the ideas could be a bit international to traders who’re used to a extra conventional technical analysis method, there’s a reason that the ICT methodology has turn into so well-liked. At their core, markets are built off of price action and development, and essential levels can play a big role in the place and why the worth reverses. ICT relies on market construction analysis, liquidity areas, buying and selling volumes, and different variables to determine one of the best commerce entries.

The ICT buying and selling methodology consists of some key ideas that each dealer must know in order to take benefit of trading in this fashion. In the sections under, we’ll discuss the key takeaways in addition to show tips on how to utilize a few of these concepts inside the TrendSpider platform. In the ICT and different methodologies, liquidity holds immense significance. Monitoring sell aspect and purchase side liquidity ranges is crucial for predicting market shifts. ICT is a technique that analyses the inner workings of the financial markets, specifically in Forex and crypto trading. This strategy was created by Michael J. Huddleston, an business veteran with over 25 years of experience.

Thus, it is a versatile technique that can be adapted to a certain scenario available in the market. Traders also can use different technical indicators, corresponding to pattern traces and transferring averages, to confirm potential reversal factors additional. The data and publications usually are not meant to be, and do not represent, monetary, investment, buying and selling, or other kinds of advice or recommendations provided or endorsed by TradingView. The world bond market is the world’s second-largest financial market, with an estimated worth of over $100 trillion. The U.S. bond market is estimated to be valued at approximately barely over $40 trillion. Liquidity’s abundance or shortage can yield each positive and unfavorable outcomes.

Sell-side Liquidity And The Cross-section Of Expected Inventory Returns

Sell-side is the part of the monetary trade that’s involved with the creation, promotion, and sale of shares, bonds, overseas exchange, and other financial instruments to the common public market. The sell-side can also embrace private capital market instruments similar to non-public placements of debt and fairness. Sell-side people and firms work to create and repair products that buy vs sell side are made available to the buy-side of the financial business. Recognizing supply and demand dynamics and acknowledging the influence of institutional buyers enhances traders’ confidence, significantly in hard-to-read markets. They strategically leverage the collected purchase orders at these highs to drive prices upward. They create good situations for buying and selling property, benefiting from value changes to get more money.

The Technique Behind Purchase Aspect And Promote Facet Liquidity

Conversely, selling liquidity refers to a point on the chart the place long-term consumers will set their cease orders. Traders frequently make incorrect predictions in areas the place they discover these points. As within the image above you can see there have been established lows and the sell stops have been resting below the lows, price after clearing the lows and sell side liquidity moved into the purchase aspect. When merchants initiate purchase orders, they usually seek to safeguard their positions by placing corresponding sell orders to mitigate potential losses. ICT strategies are usually used within the Forex, crypto and futures markets.